2025-03-19 05:47

Why did Justin Sun decide to stake $100 million worth of ETH?

What benefits does stETH provide to users in DeFi protocols?

How does ETH staking contribute to the security of the Ethereum network?

Image source: SF49 Studio for Unblock Media

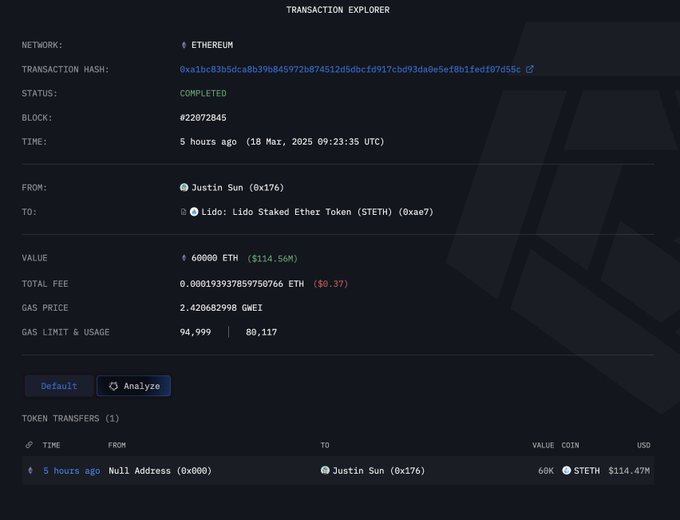

- Justin Sun stakes $100 million worth of ETH

- Utilization of stETH through Lido protocol

[Unblock Media] Justin Sun, the founder of TRON, recently staked Ethereum (ETH) worth $100 million (approximately 130 billion KRW) through the Lido liquid staking protocol.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!