Why does Michael Saylor believe the US should buy 20% of Bitcoin?

What are the potential consequences if the US government buys a large amount of Bitcoin?

What are the opinions of economic and financial experts regarding Michael Saylor's proposal?

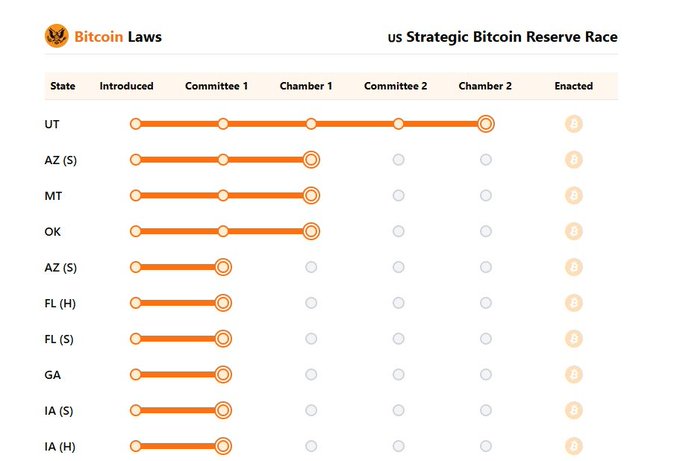

Image source: Unblock Media

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Recommended News

Global Finance and Digital Assets in a World Without Bitcoin

US banks can offer Bitcoin services freely after Fed rule change

CME to launch XRP futures in May amid rising institutional demand

Andreessen Horowitz partner says US must win the AI race as China advances