2025-02-25 09:46

What is the significance of the SEC approving Grayscale's proposal for a Cardano-based ETF?

Why is Coinbase Custody Trust Company being designated as the official custodian important?

What potential risks are associated with including Bitfinex in the ETF structure?

.png%3Fformat%3Dwebp%26width%3D800&w=1200&q=70)

Image source: Unblock Media

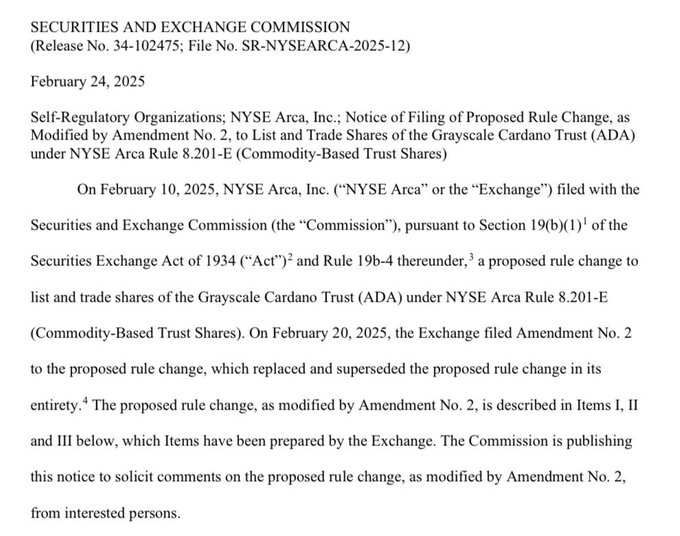

- The U.S. Securities and Exchange Commission (SEC) Approves Grayscale's Proposal

- Cardano-based Spot ETF to be Listed on NYSE Arca

[Unblock Media] The U.S. Securities and Exchange Commission (SEC) has acknowledged a proposal from cryptocurrency asset manager Grayscale, signifying a pivotal moment for the cryptocurrency ETF (Exchange-Traded Fund) market. This approval not only marks a notable individual case but is also expected to serve as a key benchmark for future regulatory directions regarding cryptocurrency-related financial products.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!

.png&w=768&q=50)