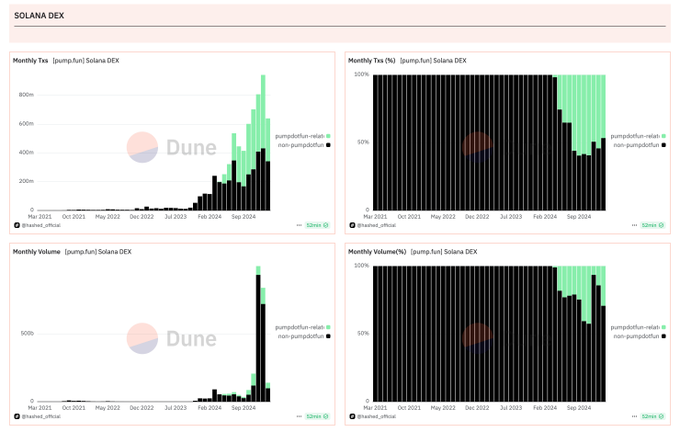

How will Pump.fun's own AMM impact Raydium?

What are the key benefits of Pump.fun's new AMM?

Why is Pump.fun's AMM test significant for the Solana ecosystem?

Image source: Unblock Media

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

.png&w=768&q=50)