12 hours ago

Why did BlackRock decide to buy $67.5 million worth of Ethereum?

How does Ethereum compare to Bitcoin in terms of institutional investment?

What are some real-world applications of Ethereum mentioned in the article?

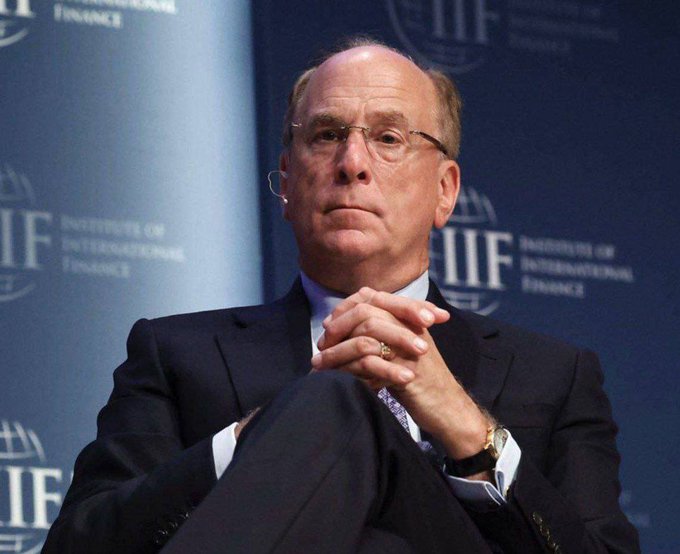

Image source: Unblock Media

- BlackRock's $67.5 million Ethereum purchase indicates growing institutional interest in smart contract assets

- Expansion of digital asset portfolio following the success of the Bitcoin spot ETF

[Unblock Media]

BlackRock's recent $67.5 million acquisition of Ethereum highlights the increasing interest among institutions in assets with smart contract capabilities. This suggests a broad reassessment of Ethereum's global financial role.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!