16 hours ago

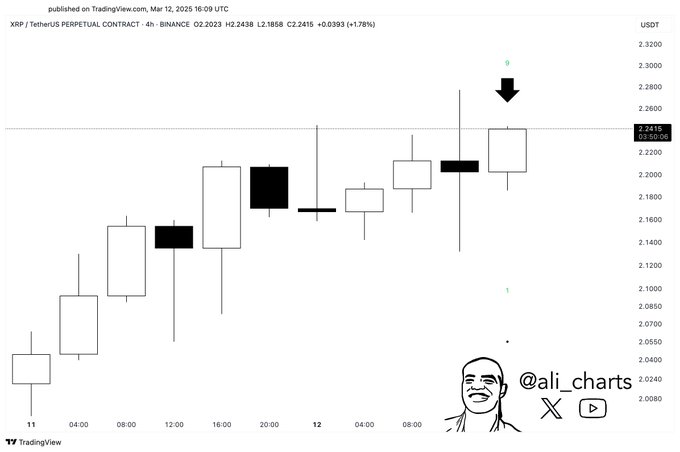

What is the TD Sequential '9' sell signal in the XRP 4-hour chart?

How could the Fed's interest rate policies affect the XRP market?

What effect could SEC regulations have on the XRP market?

Image source: Unblock Media

- XRP 4-hour Chart TD Sequential Sell Signal

- Impact of US Federal Reserve's Rate Hold and Major Economic Indicator Announcements

[Unblock Media]

Recently, technical analysis signals in the XRP market indicate an important inflection point. The TD Sequential indicator shows a sell signal on the 4-hour chart, suggesting a potential short-term price correction. Additionally, macroeconomic factors such as the US Federal Reserve's interest rate policies, key economic indicator releases, and regulatory changes are expected to influence XRP's price movements. This analysis will comprehensively examine the meaning of the TD Sequential signal and the major macroeconomic factors affecting the market.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!

.png&w=768&q=50)