6 hours ago

How might VanEck's Avalanche ETF impact AVAX's price?

What does VanEck's ETF application signify for the cryptocurrency market?

Why is the approval of VanEck's AVAX ETF important?

Image source: Unblock Media

-*VanEck applies for an Avalanche-based ETF with the US SEC

- This application is expected to strengthen the connection between the cryptocurrency and traditional financial markets

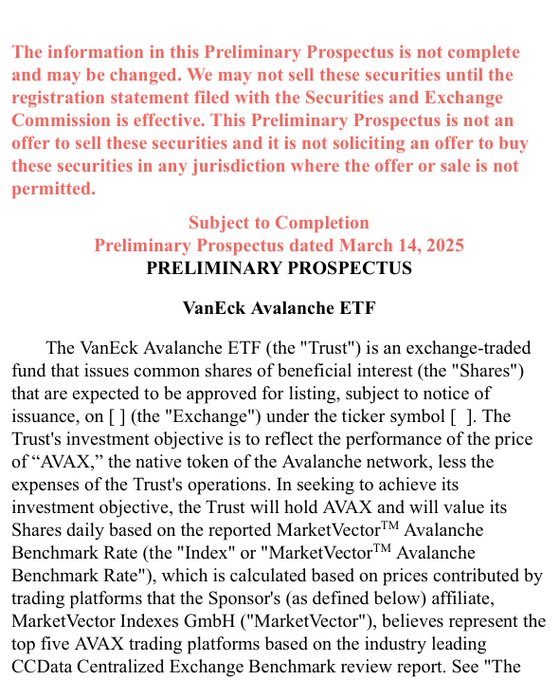

[Unblock Media] Global investment manager VanEck has applied to the US Securities and Exchange Commission for an Avalanche (AVAX) based exchange-traded fund (ETF). This application is expected to further strengthen the connection between the cryptocurrency market and traditional financial markets.

Bloomberg analyst James Seyffart revealed the ETF filing by VanEck via social media. According to the application, the 'VanEck Avalanche ETF' aims to reflect the price performance of AVAX, the native token of the Avalanche network, and offer pure returns to investors excluding operational costs. The ETF plans to directly hold AVAX and evaluate its value daily.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!