10 hours ago

Why did BlackRock recently increase their Bitcoin holdings?

How has BlackRock's Bitcoin investment influenced the BTC price?

What impact does BlackRock's Bitcoin investment have on the legitimacy of digital assets?

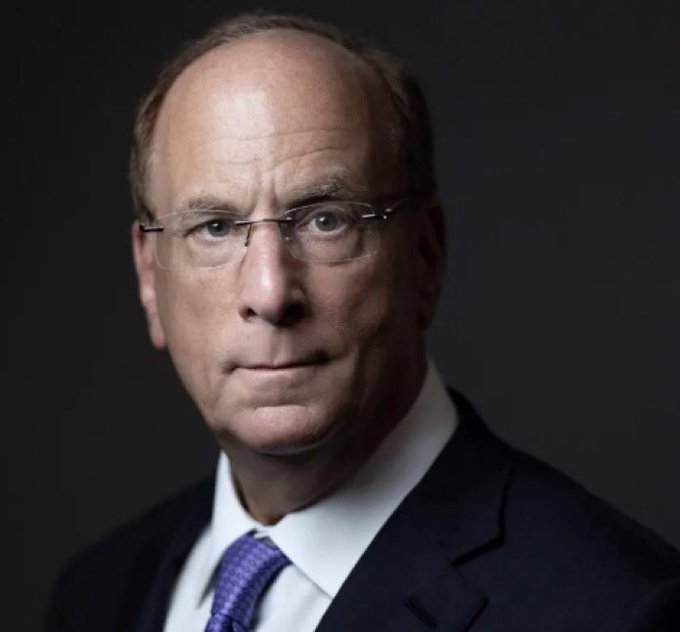

Image source: Unblock Media

- BlackRock Bitcoin Holdings Exceed $1.16 Billion

- Bitcoin Price Surpasses $85,000

[Unblock Media] BlackRock, the world's largest asset manager, has increased its Bitcoin holdings to over $1.16 billion, highlighting institutional confidence in the cryptocurrency market.

The recent estimated purchase of $327.3 million by the company is attributed to the growing demand for regulated access to Bitcoin and the strong performance of the spot Bitcoin ETF approved earlier this year.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!